Your All-In-One Mortgage Calculator and Loan Assistant

A smart, self-service mortgage tool built for anyone who wants to buy a home, refinance, compare rates, or understand their monthly payment. Works for every state in the United States with the same insight a loan officer provides.

No sales pressure. No complicated math. Just clear numbers and real guidance.

Who aria.mortgage Is For

Homebuyers

See how much home you can afford, calculate down payment, estimate cash to close, and explore different loan programs.

Homeowners

Check if a refinance makes sense. Compare interest rates and monthly payments across multiple scenarios.

Rate Shoppers

View different interest rate options and discount points so you can understand how rates change your payment.

Anyone Wanting Clarity

See your qualifying income, debt-to-income ratio, and your complete mortgage picture in minutes.

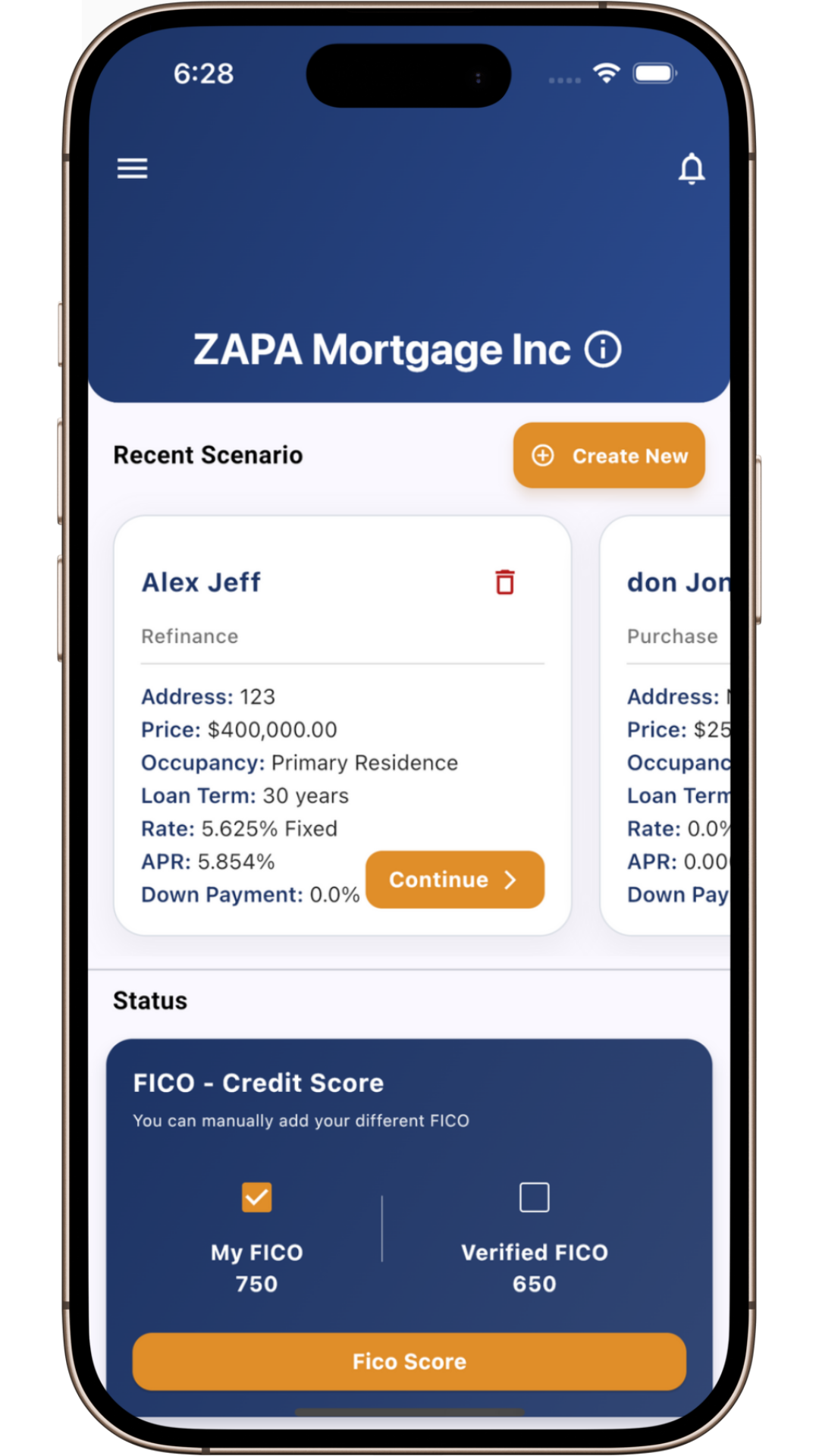

See aria.mortgage in Action

Anyone, in today's world, looking for a home mortgage loan, has millions of questions. The most popular 3 questions are: What is my Interest Rate? What is my Cash to Close? and What is my Monthly Payment? When you search answer to these questions, you do not get a clear and honest answer. Why? Coz just like your finger prints, no two loan applicants and their needs are different. You cannot have a 'one size fit all' answer to your burning questions.

aria.mortgage is an app, supported by many licensed Residential Mortgage Loan Originator aka RMLOs, which empowers you to run unlimited numbers of scenarios, generate Fee Wroksheets, which include answers to all your questions! and all these answers are specific to you.

This app will allow you to run all kinds of what-if scenarios? The same questions, that you wish to ask your RMLO and you can't.

What's my current Credit Score? What-if my score is 20 points higher? Is it going to impact my Cash to Close? or will it help reduce my Interest Rate?

I just heard the Interest Rates dropped! How will this impact me? What is the Interest Rate right now?

What if I buy a home worth $300,000. will I qualify? Or If I wish to buy a home worth $500,000 what is the income needed while evaluating my scenario?

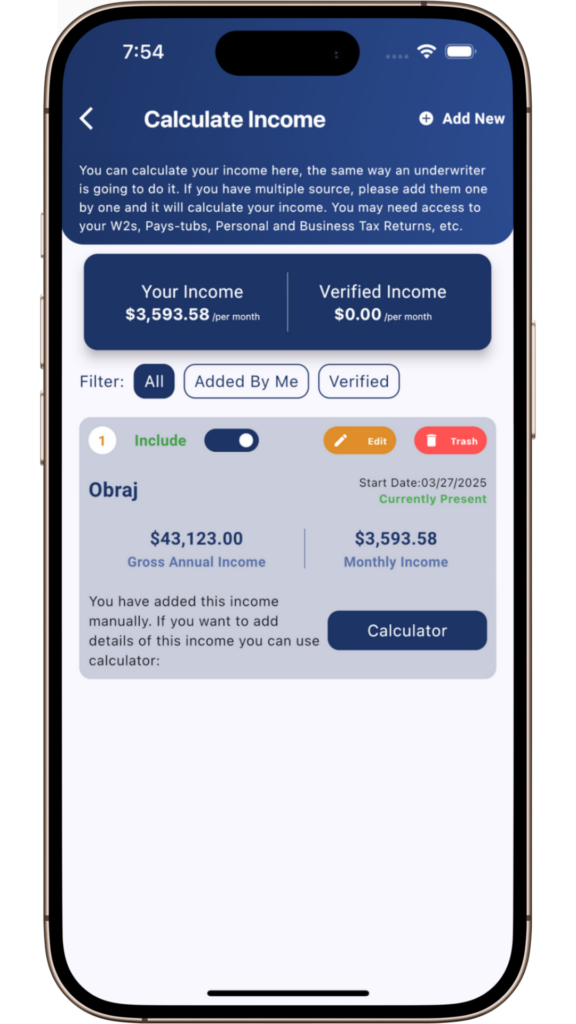

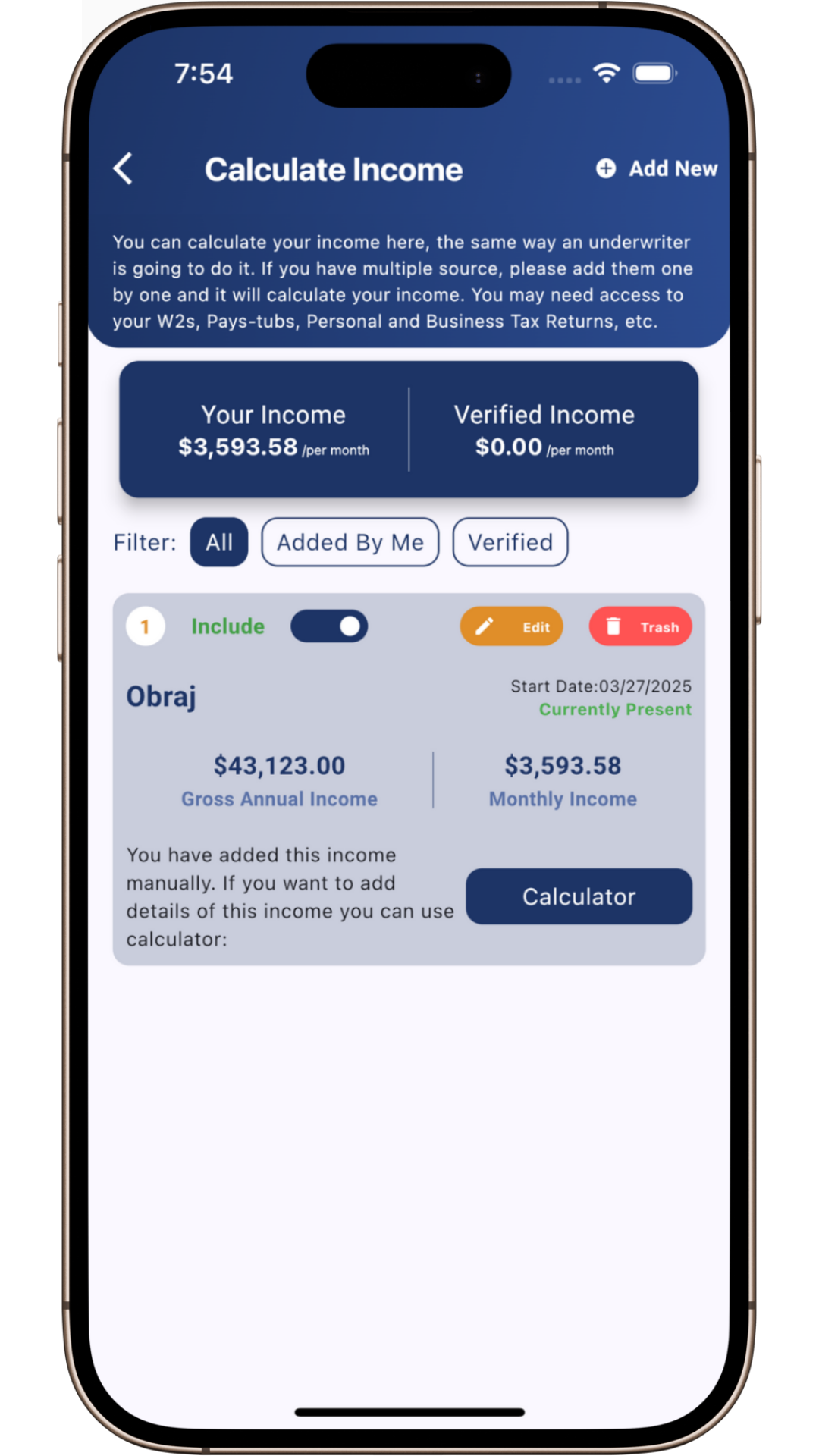

How can I calculate my income like my RMLO does? I've multiple businesses, can I calculate income on my own? What if my income increases or decreases? What's the impact? Will I still qualify? How to calculate my bonus and commission income? What about my Investment Property Rental income? I receive other income like Child Support or Alimony or Social Security Income, How does an RMLO calculate that for my loan?

I'm buying a home and negotiate a Seller's Concession. How this will help with my Cash to Close? or help with buying my rate down? What if I 've a second loan, how will it come to play?

I wish to generate scenarios for every home that I see on MLS service! I want to feel free when I start the Mortgage Loan process!

If that is you with all these questions, this app is for you. No more filling lengthy long forms thinking I 'll get my answer and instead there is a long line fo RMLOs trying to win my business. I know, all these re trying to help;p me but what if I'm not ready! Not Yet!! Just testing waters!!

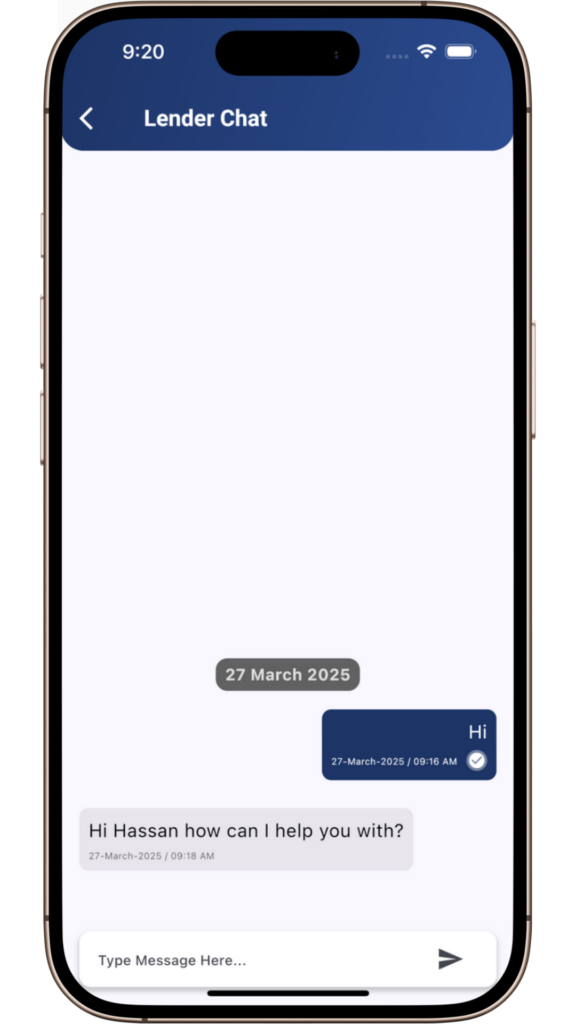

And yet, I'll have an RMLO available to answer any questions on the fly; and I'll have access to a Real Estate Agent who can guide me through the process.

This app will also allow me to generate a pre-qualification or pre-approval letter, generated by me, at will, and without talking to any RMLO. Kinda Self Service! And as many letters that I need, 24 hours a day, for as many home scenarios as I can think of.

As of today, no-one is allowing a consumer to self-servcie their own mortgage loan process. This app, just like a financial mortgage calculator game, lets you do all this and more.

This app is TCPA compliant and will not result in you receiving millions of calls when you fill in a home mortgage inquiry form!

Download today and enjoy!

Self-Service, Loan Officer Level Power

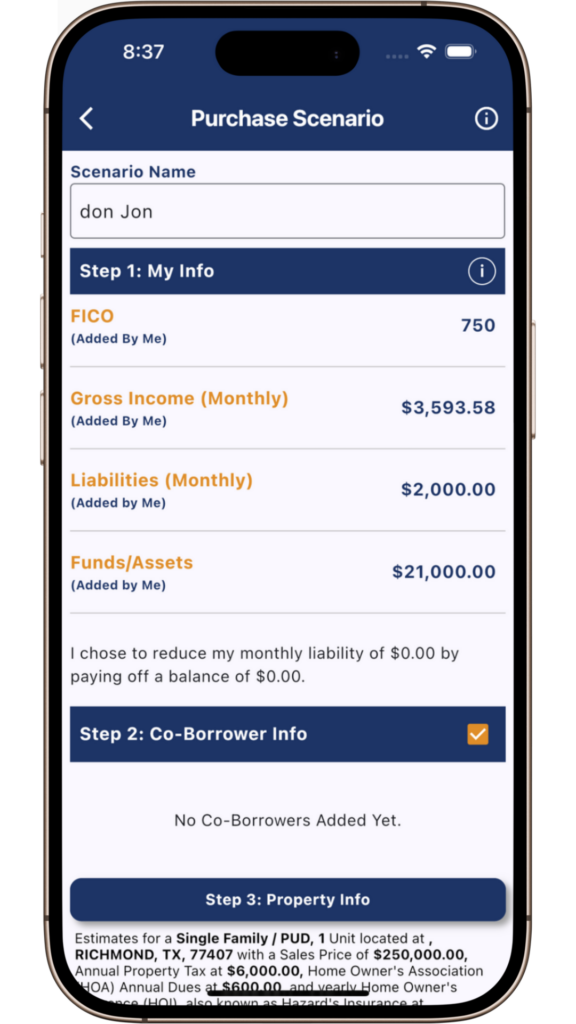

aria.mortgage lets you do everything a loan officer can do, but in an easy, guided format:

- Calculate monthly payments

- Compare purchase and refinance options

- Estimate cash to close

- Review down payment options

- Run loan scenarios for Conventional, FHA, VA, USDA, Jumbo, and Non-QM

- Adjust income, credit score, liabilities, assets, and property details

- Generate a real Fee Worksheet with rates

aria.mortgage puts all the decision-making tools directly in your hands.

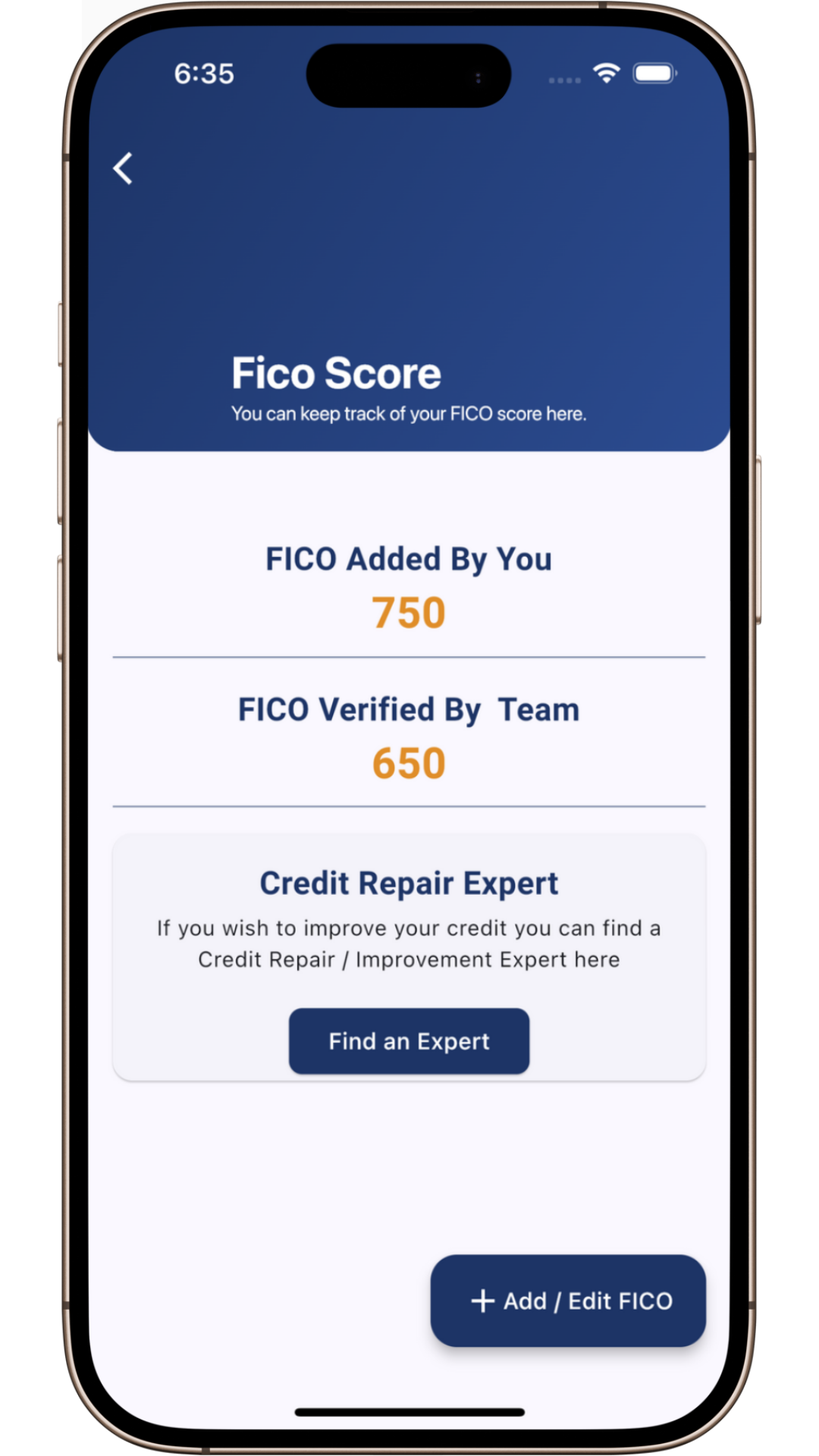

Real Credit Data. No Hard Inquiry.

TransUnion FICO 4 Mortgage Score

This is not a general credit score. It is a real mortgage-grade scoring model used by lenders. You receive the real score, the one lenders actually look at.

Soft Credit Pull

No impact to your credit score. Pull your credit safely and securely.

Direct Connection

Direct connection through MySoftCredit, used instantly in your loan calculations.

You Control Your Data

You decide when to pull your credit. Your lender cannot pull it unless you grant permission.

Complete Financial Snapshot

aria.mortgage builds your full mortgage profile based on the information you enter:

Income

- Wage income

- Self-employed income

- Business income

- Rental income

- Social Security

- Child support

- Alimony

- Many other sources

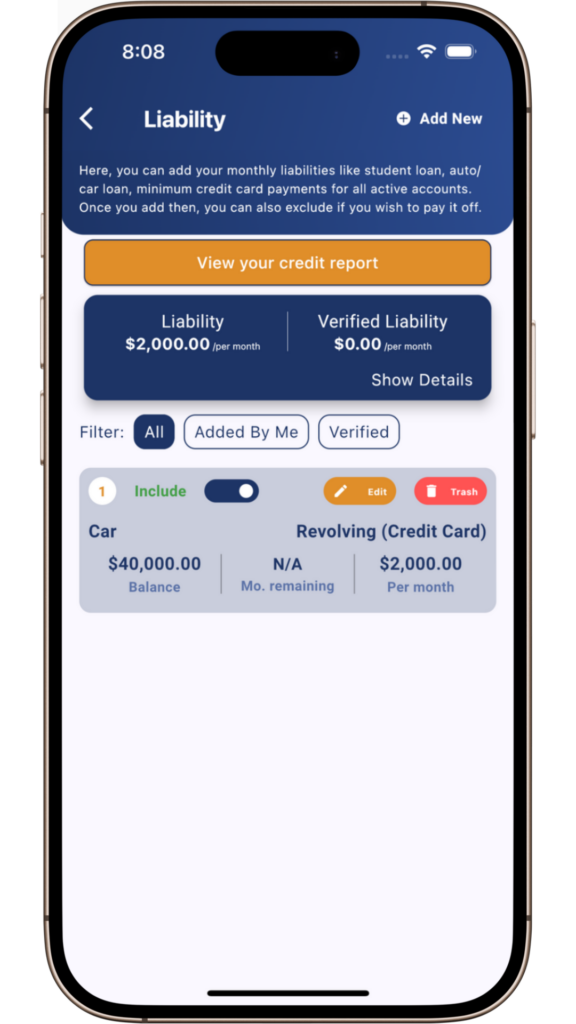

Liabilities

- Auto loans

- Credit cards

- Student loans

- Mortgages

- Any other monthly payment

- Option to mark items as paid-off at closing

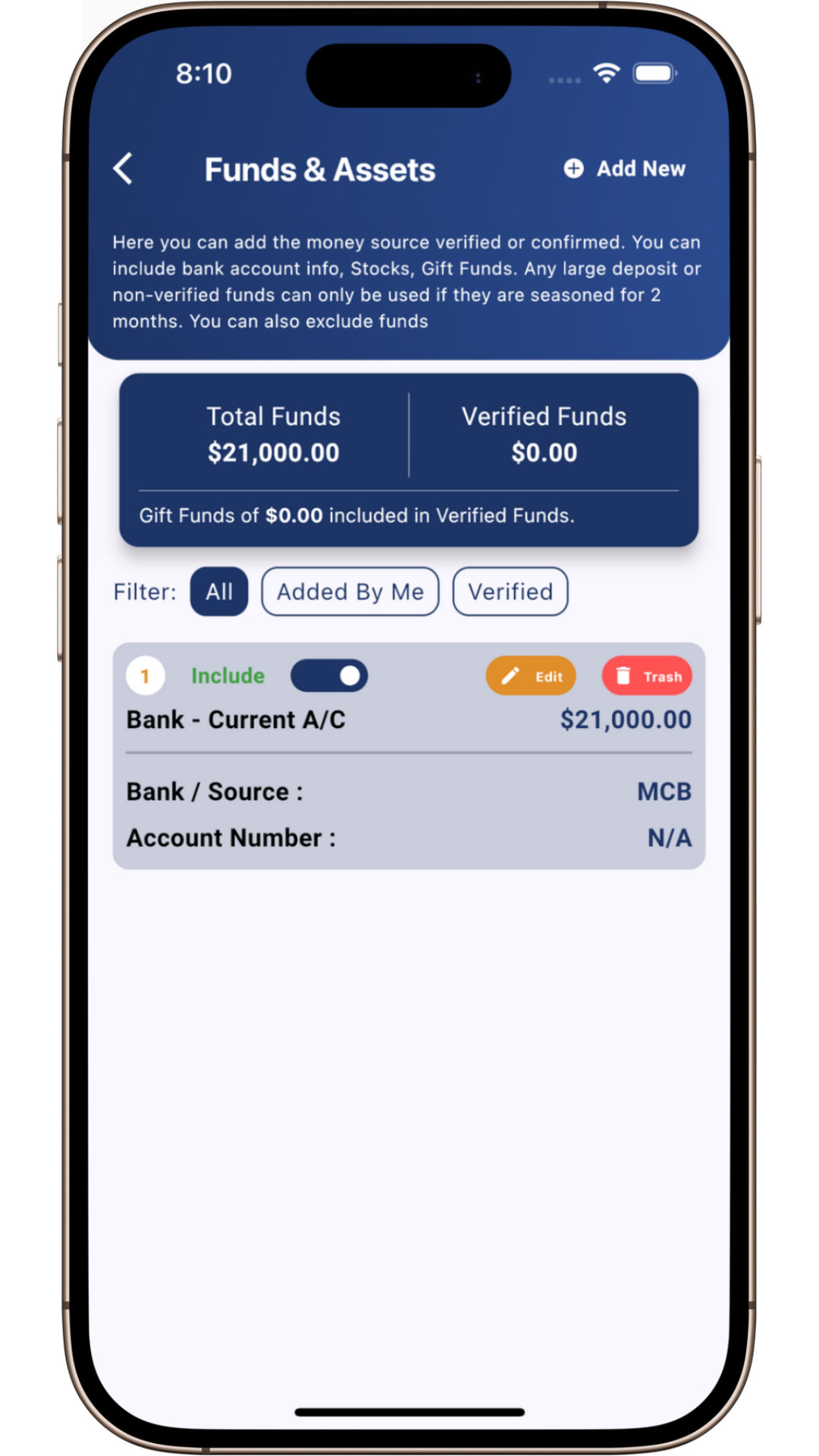

Assets and Funds

- Bank accounts

- Gift funds

- Stocks

- Verified and unverified assets

- Seasoned funds tracking

This gives you an accurate debt-to-income ratio and a clear picture of your purchasing power.

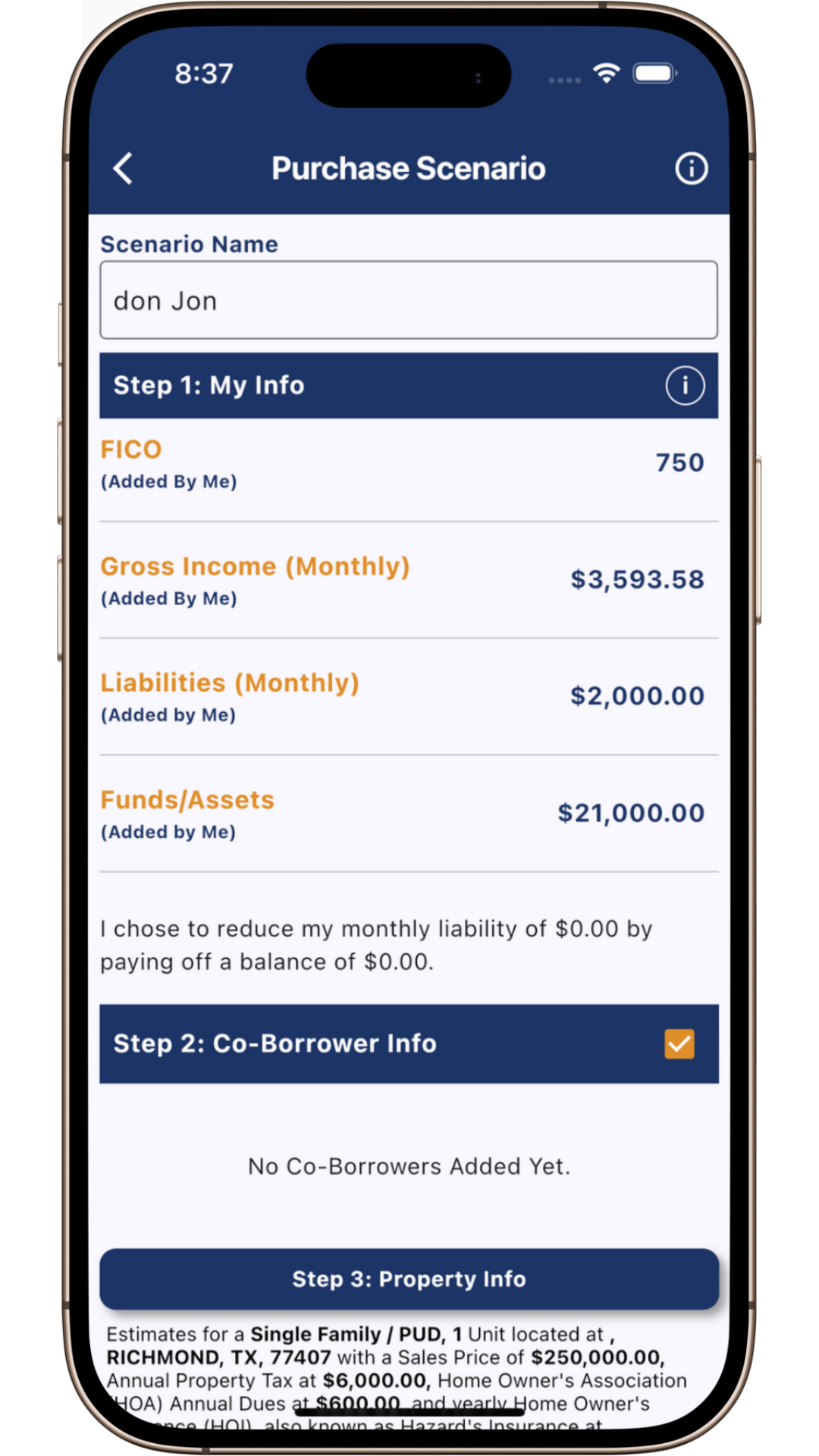

Build Multiple Loan Scenarios

Create unlimited scenarios for purchase or refinance:

- Enter property details

- Select a loan program

- Choose occupancy type: primary, second home, or investment property

- Add down payment assistance

- Enter closing cost credits

- Compare rate options

- Lock periods

- Buydown options

- First-time homebuyer selections

aria.mortgage shows you how every choice changes your payment.

Instant Monthly Payment and Cash to Close

Your Monthly Payment

- Principal and interest

- Property tax

- Homeowners insurance

- Mortgage insurance (when required)

- HOA fees (if any)

- Full estimated monthly payment

Cash to Close Breakdown

- Total cash to close

- Earnest money impact

- Credits applied

- Lender fees

- Prepaids and reserves

Everything is displayed clearly so you know exactly what to expect.

More Powerful Features

Fee Worksheet (PDF)

Generate a complete Fee Worksheet containing your rate, loan terms, closing costs, cash to close, and payment breakdown. Download, share, or send it to your loan officer.

Add Co-Borrower

See how adding another borrower affects qualification. Enter co-borrower income, FICO, and liabilities. Include or exclude them instantly for comparison.

Why aria.mortgage

Built with Heart

aria.mortgage is built with the heart of the aria brand, symbolized by the Aria Butterfly: kindness, transformation, and human understanding. The app empowers borrowers with clarity, fairness, and complete transparency.

You should never feel lost when making one of the biggest financial decisions of your life. aria.mortgage is here to give you confidence.

The Fastest Growing App on the Play Store

Play Store Downloads

Apple Store Downloads

User Reviews

App Screens

aria.mortgage